2024 Business Expense Deductions Allowed – Commuting Expenses Commuting expenses from home to work are generally not deductible as a business expense. But if you operate your baby-sitting business in your home and use a portion of your . it pays to make a list of your business expenses and talk to an accountant about deducting them on your taxes. And you may be surprised at what you’re allowed to claim. Let’s say you perform in a .

2024 Business Expense Deductions Allowed

Source : www.freshbooks.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.com2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comTax Deduction Definition: Standard or Itemized?

Source : www.investopedia.com2024 Important Tax Changes Brochure IMPRINTED (25/pack) Item

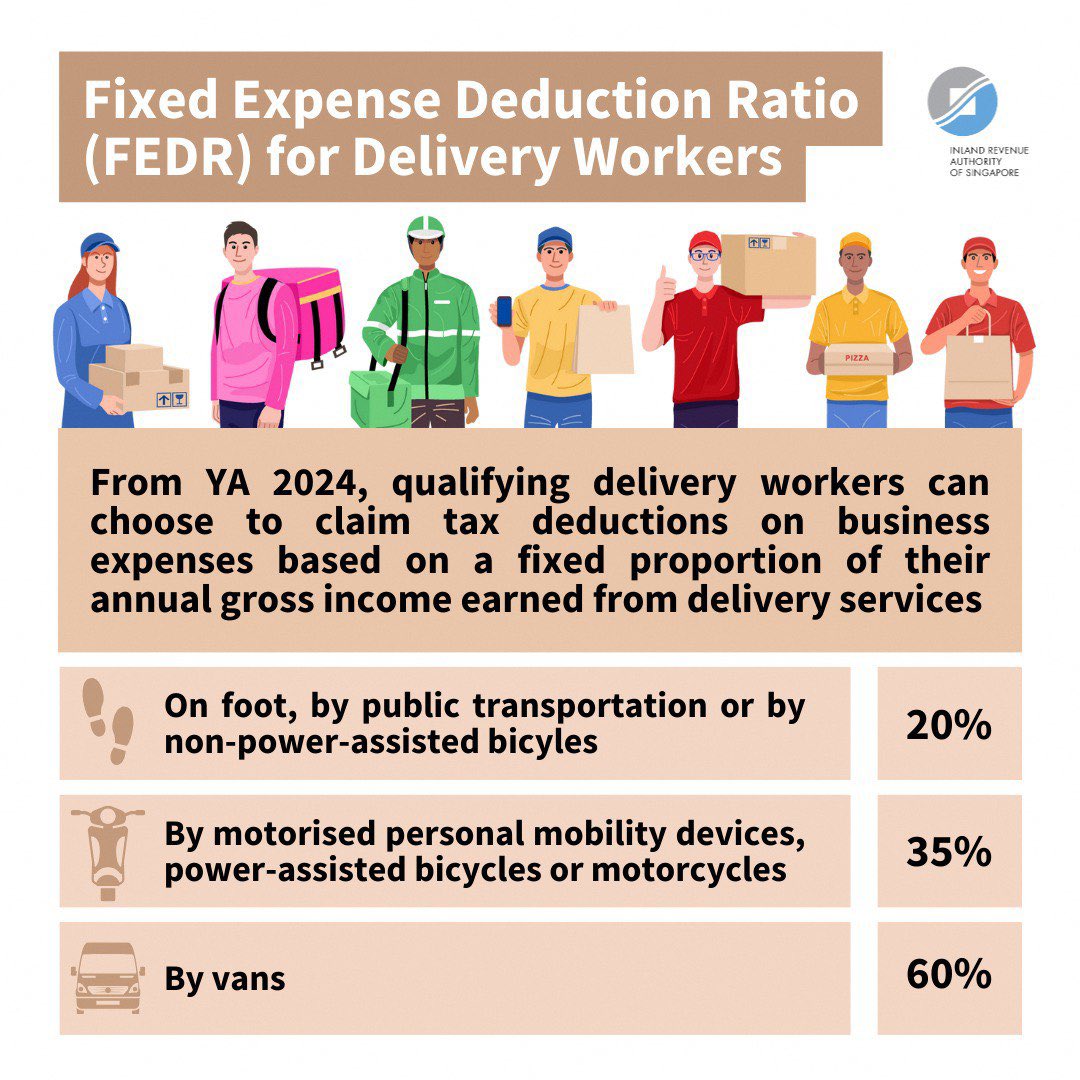

Source : www.tangiblevalues.comIRAS on X: “Good news for delivery workers! 🙌🏻 With effect from

Source : twitter.comThe Best Business Mileage Tracker Apps for 2024

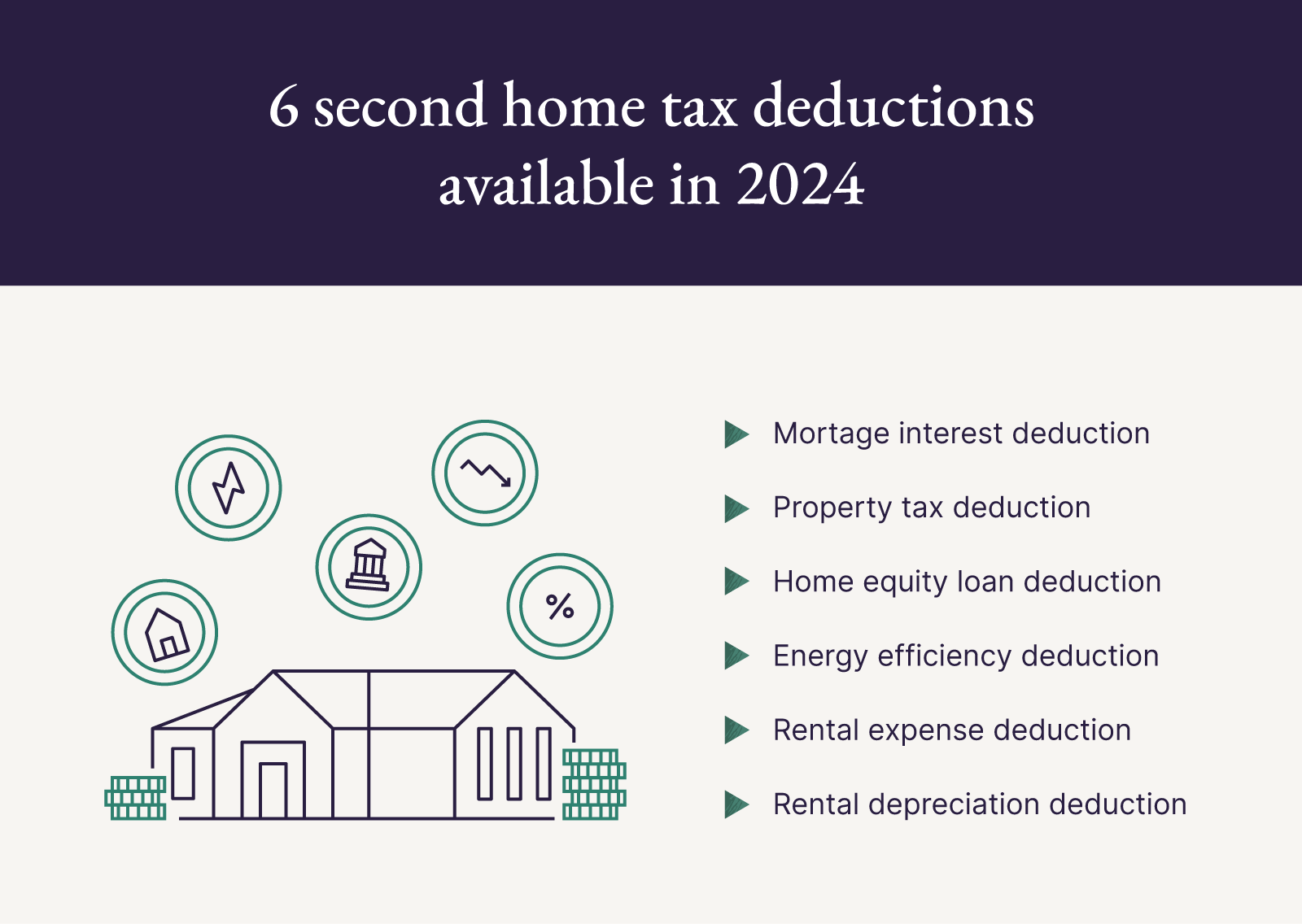

Source : www.fylehq.com6 Second Home Tax Deductions to Claim in 2024 Pacaso | Pacaso

Source : www.pacaso.comDos and Don’ts for Business Expense Deductions – The Burns Firm

Source : www.theburnsfirm.com2024 Business Expense Deductions Allowed 25 Small Business Tax Deductions To Know in 2024: you’re allowed to switch back and forth. (Yet another weird intricacy in the world of the IRS.) So far, you’re probably thinking that deducting business expenses is easy. But there are some . The allowed mileage rate changes yearly Home Office Expenses You can claim part of your home expenses as business related if you meet the qualifications specified by the IRS. .

]]>

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)